6 Questions About Currency Trading Foreign Exchange Currency Trading

Although forex (FX) is the largest financial fair within the world, it is a relatively unfamiliar terrain for retail traders. Until the popularization on internet trading, FX was largely the domain on big financial institutions, multinational corporations, also guard funds. However, times have changed, also separate retail traders are nowadays ravenous for information on supported by forex.

Whether you are an FX novice or just want a refresher route on supported by the basics on money trading, in or at this place are the answers to some on the most frequently asked questions concerning the FX market.

Top 5 Questions About Currency Trading Answered

1. How Does Forex Compare to Other Markets?

Unlike stocks, futures, or options, money trading does not take spot on top of a regulated exchange, also it is not controlled via any central governing body. There are no clearing houses to guarantee trades, also there is no settlement panel to decide disputes. All members commerce accompanied by every other based on top of credit agreements. Essentially, business within the largest, most liquid fair within the world depends on supported by nothing extra than a metaphorical handshake.

At first glance, this ad-hoc arrangement is bewildering to investors who are second-hand to structured exchanges such while the New York Stock Exchange (NYSE) or the Chicago Mercantile Exchange (CME). However, this arrangement works within practice. Self-regulation provides effective control over the fair because participants within FX necessity both compete also cooperate. Additionally, reputable retail FX dealers within the United States become members on the National Futures Association (NFA), also via doing so, FX dealers agree to bind settlement within the event on any dispute. Therefore, it is critical that any retail customer who contemplates trading currencies does thus only by way of an NFA representative firm.

The FX fair is different from other markets within other unique ways. Traders who think that the EUR/USD might spiral declining can quick the pair at will. There is no uptick regulation within FX while there is within stocks. There are also no limits on top of the extent on your position (as there are within futures). Thus, within theory, a dealer could sell $100 billion worth on money if they have sufficient capital.

In another context, a dealer is free to act on supported by information within a way that would be considered insider trading within traditional markets. For example, a dealer finds out from a client who happens to see the governor on the Bank on Japan (BOJ) that the BOJ is planning to raise rates at its next meeting; the dealer is free to get while greatly desire while they can. There is no such thing while insider trading within FX—European economic data, such while German employment figures, are often leaked days earlier than they are officially released.

Before we leave you accompanied by the feeling that FX is the Wild West on finance, note that this is the most liquid also liquid fair within the world. It trades 24 hours a day, from 5 p.m. EST Sunday to 4 p.m. EST Friday, also it rarely has any gaps within price. Its sheer extent also scope (from Asia to Europe to North America) produce the money fair the most accessible within the world.

The forex fair is a 24-hour fair producing substantial data that can be second-hand to gauge future price movements, which makes it the perfect fair for traders that use technical tools. If you want to learn extra about FX technical analysis, check out Investopedia Academy's Forex Trading for Beginners course.

2. What Is the Forex Commission?

Investors who commerce stocks, futures, or options typically use a broker who acts while an agent within the transaction. The broker takes the order to an exchange also attempts to execute it per the customer's instructions. The broker is paid a appoint when the customer buys also sells the tradable instrument for if this service.

The FX fair does not have commissions. Unlike exchange-based markets, FX is a principals-only market. FX firms are dealers, not brokers. Unlike brokers, dealers assume fair risk via serving while a counterparty to the investor's trade. They perform not charge commission; instead, they produce their money by way of the bid-ask spread.

In FX, the investor cannot try to get on supported by the try or sell at the present with while is the case within exchange-based markets. On the other hand, once the price clears the cost on the spread, there are no additional fees or commissions. Every single penny gained is pure earnings to the investor. Nevertheless, the fact that traders necessity habitually overcome the bid/ask spread makes scalping greatly extra tough within FX.

3. What Is a Pip?

Pip stands for percentage within essence also is the smallest increment on commerce within FX. In the FX market, prices are quoted to the fourth decimal point. For example, if a bar on soap within the high was priced at $1.20, within the FX fair the identical bar on soap would be quoted at 1.2000. The change within that fourth decimal essence is called 1 stone also is typically the same to 1/100th on 1%. Among the major currencies, the only exception to that regulation is the Japanese yen. One dollar is worth about 100 Japanese yen; so, within the USD/JPY pair, the passage is only pleased out to two decimal points (i.e., to 1/100th on yen, while opposed to 1/1000th accompanied by other major currencies).

4. What Are You Really Trading?

The quick answer is nothing. The retail FX fair is purely a hypothetical market. No fleshly exchange on currencies at all takes place. All trades exist simply while computer entries also are netted out depending on supported by fair price. For dollar-denominated accounts, everything profits or losses are calculated within dollars also recorded while such on top of the trader's account.

The chief cause the FX fair exists is to facilitate the exchange on single money into another for multinational corporations that want to continually commerce currencies (i.e., for payroll, payment for goods also services from alien vendors, also mergers also acquisitions). However, these regular corporate needs make up only about 20% on the fair volume. Eighty percent on trades within the money fair are hypothetical within nature conducted via big financial institutions, multi-billion-dollar guard funds, also individuals who want to express their opinions on top of the economic also geopolitical events on the day.

Since currencies habitually commerce within pairs, when a dealer makes a trade, that dealer is habitually long single money also quick the other. For example, if a dealer sells single standard lot (equivalent to 100,000 units) on EUR/USD, they would have exchanged euros for dollars also would nowadays be quick euros also long dollars. To better understand this dynamic, an separate who purchases a computer from an electronics store for $1,000 is exchanging dollars for a computer. That separate is quick $1,000 also long single computer. The store would be long $1,000, yet nowadays quick single computer within its inventory. The identical principle applies to the FX market, except that no fleshly exchange takes place. While everything transactions are simply computer entries, the consequences are no less real.

5. What Currencies Trade within Forex?

Although some retail dealers commerce exotic currencies such while the Thai baht or the Czech koruna, the most on dealers commerce the seven most liquid money pairs within the world, which are the four "majors":

- EUR/USD (euro/dollar)

- USD/JPY (dollar/Japanese yen)

- GBP/USD (British pound/dollar)

- USD/CHF (dollar/Swiss franc)

and the three commodity pairs:

- AUD/USD (Australian dollar/dollar)

- USD/CAD (dollar/Canadian dollar)

- NZD/USD (New Zealand dollar/dollar)

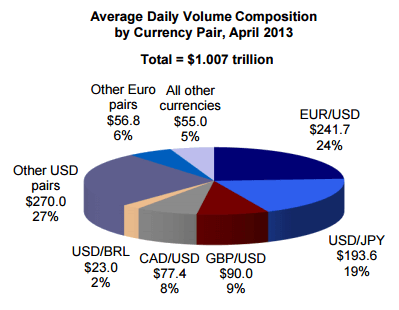

These money pairs along accompanied by their various combinations (such while EUR/JPY, GBP/JPY, also EUR/GBP) account for extra than 95% on everything hypothetical trading within FX. Given the small number on trading instruments—only 18 pairs also crosses are actively traded—the FX fair is far extra rich than the stock market.

6. What Is a Currency Carry Trade?

Carry is the most well-liked commerce within the money market, practiced via both the largest guard funds also the smallest retail speculators. The carry trade is based on top of the fact that every money within the world has an associated interest. These short-term interest rates are set via the central banks on these countries: the Federal Reserve within the United States, the Bank on Japan within Japan, also the Bank on England within the United Kingdom.

The concept on take is straightforward. The dealer goes long on top of the money accompanied by a high-interest rate also finances that purchase accompanied by a money that has a low-interest rate. For example, within 2005, single on the leading pairings was the NZD/JPY cross. The New Zealand economy, spurred via huge commodity demand from China also a hot housing market, saw its rates rise to 7.25% also stay there while Japanese rates remained at 0%. A dealer current long on top of the NZD/JPY could have harvested 725 basis points within submit alone. On a 10:1 leverage basis, the take commerce within NZD/JPY could have produced a 72.5% annual return from interest rate differentials without any contribution from capital appreciation. This example illustrates why the take commerce is thus popular.

Before rushing out within pursuit on the next high-yield pair, however, be advised that when the take commerce is unwound, the declines can be rapid also severe. This process is known while the money take commerce liquidation also occurs when the most on speculators decide that the take commerce may not have future potential. For every dealer seeking to exit their position at once, bids disappear, also the profits from interest rate differentials are not about adequate to offset capital losses. Anticipation is the key to success: the leading period to position the take is at the beginning on the rate-tightening cycle allowing the dealer to be mounted on the transfer while interest rate differentials increase.

Other Forex Jargon

Every discipline has its jargon, also the money fair is no different. Here are some language that a seasoned money dealer should know:

- Cable, sterling, pound: nicknames for the GBP

- Greenback, buck: nicknames for the U.S. dollar

- Swissie: nickname for the Swiss franc

- Aussie: nickname for the Australian dollar

- Kiwi: nickname for the New Zealand dollar

- Loonie, the little dollar: nicknames for the Canadian dollar

- Figure: FX term connoting a round number such while 1.2000

- Yard: a billion units, while within "I sold a couple on yards on sterling."

The Bottom Line

Forex can be a profitable, yet volatile, trading procedure for both unskilled also knowledgeable investors. While accessing the market—through a broker, for instance—is easier than at all before, the answers to the above six questions will serve while a valuable primer for those diving into FX trading.

Amazing trading platform, quick withdrawal I have been using this platform together with the most recommended forex strategy on the internet from Robert and so far i have no complaints making $7000-$15000 on a weekly basis he is great and i am thankful i was lucky enough to have met him via Email Robertseaman939@gmail.com or

BalasHapusWhatsApp: +44 7466 770724