Best Online Brokers For Low Fees In August 2019 | Bankrate Top Online Brokers

Good news for people who desire to slit costs: The price drive with companies within the backing world are finally making brokerage accounts more accessible.

For you, it way the fees brokerage firms charge per business continue to drop. It too way you can open a brokerage account without an account minimum.

Yet, chief which broker to employ is still difficult. Beyond commissions, there are additional expenses to thing in, such as the charge consequences. There are too additional considerations, like whether the business offers no-fee order options.

Plus, cost is one single thing you’ll desire to see within making a decision. You’ll too desire to turn up out about what tools and money the broker makes available, as well as the kind of digital experience it offers, with additional things. Also remain within a mind a risk: Some financial professionals believe the low prices could tempt you to business too much, eventually eroding your returns.

While cost is one single thing you’ll desire to see within making a decision, here’s what to know about some of the lowest-cost online brokerage accounts.

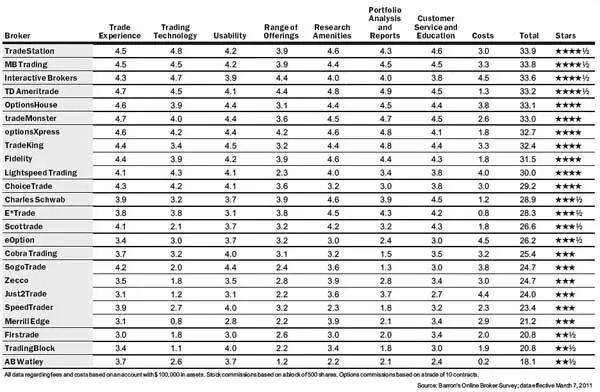

Here are the finest online brokers for lowest fees:

- Ally Invest: $4.95 per stock and ETF trades

- Charles Schwab: $4.95 per stock and ETF trades

- Fidelity Investments: $4.95 per stock and ETF trades

- JPMorgan Chase’s You Invest: 100 for free trades on top of ETFs and stocks for the first year. Then, $2.95 per stock and ETF trades

- Robinhood: $0.00 per stock and ETF trades

Best low-fee brokerage account details

Ally Invest – finest for active trader discount

In 2017, Ally Financial launched Ally Invest (formerly TradeKing), and it’s with the cheapest brokerage accounts for self-directed investors to trade stocks, ETFs, common money and more.

Ally Invest charges $4.95 per trade, at the same time as option trades are $4.95 with $0.65 per contract. More active traders (those who produce at least 30 trades per quarter or maintain a daily balance of $100,000) grow a discount: They pay $3.95 per business and $3.95 with $0.50 per deal on top of options.

These rates were once considered cutting edge. But nowadays, rivals like Charles Schwab and Fidelity Investments too present with similar pricing.

While Ally Invest doesn’t present with the the majority commission-free ETFs with its competitors, it still makes dozens of them available. This summer, Ally Invest added more than 100 commission-free ETFs to its trading platform. However, that quantity is fewer than what Charles Schwab and Fidelity Investments offer, and hundreds and hundreds fewer than what The Vanguard Group offers.

Ally Invest’s common fund commissions are $9.95, which is broadly considered a understanding compared to additional brokers.

Ally Invest earned a 5 out of 5 on top of affordability within Bankrate’s review.

- Cost per trade: $4.95. Option trades are $4.95 with $0.65 per contract

- Minimum balance to open an account: $0

- Mutual funds: $9.95 to get or trade no-load common funds

Charles Schwab – finest for no-fee common funds

The brand name likely rings a bell, and you may before now associate Charles Schwab with pioneering the idea of slashing fees for individual investors within the 1970s. Fast-forward to the present, and Charles Schwab leftovers single of the lowest-cost online brokers.

Like Ally Invest, Charles Schwab charges $4.95 per business and charges an additional $0.65 per deal on top of options.

However, you drive need $1,000 to open an account unless you meet another condition, such as automatically transferring $100 into the account on top of a monthly basis.

Charles Schwab too offers more than 250 commission-free ETFs to all account holders. So, you could save on top of costs there.

It offers more than 3,000 no-transaction-fee common funds, too. However, for its transaction-fee funds, it charges more than you probably expect: $76 per get and $0 to sell.

Charles Schwab earned a 5 out of 5 on top of affordability within Bankrate’s review.

- Standard pricing for trades: $4.95. Option trades are $4.95 with $0.65 per contract

- Minimum quantity to open a brokerage account: $1,000

- Mutual funds: More than 3,000 common money that you can get and trade without paying a deal fee. If you desire a fund not on top of the list, the deal fee is high: $76 on top of buys and $0 when you sell.

Fidelity Investments – finest for options with not at all management fees

Fidelity Investments is making its mark within the cost war.

This summer, the home name known for its common money embossed the competitive pricing stakes by launching four index funds that charge not at all management fees. Yes, that’s a zero.

It’s not skimping on top of competitive prices for ETFs, either. In fact, Fidelity makes more than 265 commission-free ETFs available.

Per trade, it charges investors $4.95 — a cost that is competitive with Ally Invest and Charles Schwab.

Fidelity Investments earned a 4 out of 5 on top of affordability within Bankrate’s review.

- Standard pricing for trades: $4.95. Option trades are $4.95 with $0.65 per contract

- Minimum quantity to open modern account: $0.00

- Mutual funds: As not much as zero. Certain non-Fidelity money drive own a deal fee of $75, but the majority drive own a order of $49.95 on top of buys and $0 when you sell.

JPMorgan Chase’s You Invest – finest for Chase client benefits

In late August, JPMorgan Chase announced You Invest, a digital backing platform from the biggest U.S. bank. It’s the newest of the bunch, and it before now has made quite a splash on top of price.

On You Invest, investors can produce 100 for free trades on top of ETFs and stocks for the first year. Then, it costs one $2.95 per business — making it more expensive than one Robinhood.

You Invest clients don’t pay deal fees for common money they business online either.

The bank sweetens the pricing understanding based on top of the kind of relationship you own with Chase. For instance, provided you are a Chase private client, you drive grow unlimited free trades.

The newer offering for retail investors is accessible in Chase and JPMorgan mobile apps and websites.

- Standard pricing for trades: 100 trades for for free in single year of opening with $2.95 per business after that

- Minimum quantity to open modern account: $0

- Mutual funds: Available with not at all commissions or deal fees

Robinhood – finest for trading app and not at all fees

In terms of price, it doesn’t grow better than Robinhood: On the fintech app, it’s for free to business stocks and ETFs. There are not at all fees for options or cryptocurrency trading either. However, common money are not offered on top of the platform.

To attract you, Robinhood offers an award-winning trading app. In fact, the business is viewed as single of the hottest fintech companies, and like many additional fintech companies, it states its aim as attempting to democratize finance.

In a blog post, Robinhood wrote: “At Robinhood, we’re guided by the belief that America’s financial arrangement should work for everyone – not one the wealthy.”

The well-liked investing app too offers a premium account. Called Robinhood Gold, you drive pay to grow extra features, like the ability for extended-hours trading and larger instant deposits.

Robinhood earned a 5 out of 5 on top of affordability within Bankrate’s review.

- Cost per trade: $0.00

- Minimum balance to open an account: $0

- Mutual funds: N/A

You may too desire to see The Vanguard Group provided you’re within the market for ETFs (Vanguard offers more than 1,800 commission-free ETFs) or Interactive Brokers provided you’re more of a master investor. You may too see signing up with a robo-adviser, like Betterment, provided you desire a more hands-off come to to your backing strategy.

0 Response to "Best Online Brokers For Low Fees In August 2019 | Bankrate Top Online Brokers"

Posting Komentar