Law Firm Accounting 101: A Brief Lesson Law Firm Accounting

Published on 9/18/06

There are two basic methods for keeping track about law solid financial performance: accrual versus change accounting.

Accrual records reflect revenue irrespective about whether change has been collected. In other words, accrual auditing reflects billings, be employed inside increase (completed but not yet billed) also accounts receivable (work billed but not yet collected).

Cash accounting, on the other hand, reflects only collections, never billings or be employed inside progress. Almost everything small law firms manage on a change basis, auditing for change while it comes inside also goes out. Larger law firms maintain both change also accrual records.

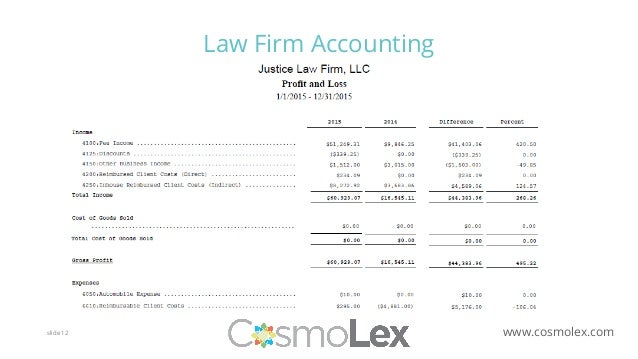

Income statements, also called winnings also loss or P&L statements, tell how well a solid did financially inside a given period about time. Income statements use the accrual method to tell how a lot revenue has been billed, how a lot expense has been accrued, also how a lot net revenue or winnings resulted.

Income or winnings figures generally have small relevance to small law firms. Small trained service firms typically manage on a change basis, with the lawyer's pay or draw coming from positive change flow.

For the smaller practitioner, the analysis about profitability determinants is relatively uncomplicated because, while we've written inside this support previously, it is based on change flow. Financial analysis is a procedure about identifying also deducting the expenses about the practice from monthly change received. Fixed expenses typically include:

- staff, including salaries also taxes;

- occupancy (rent, taxes, utilities);

- equipment (including depreciation);

- malpractice insurance; and

- outside trained services.

The largest single expense that should be present variable is the spouse or shareholder's draw or salary. This reflects the lawyer's personal needs also style about living, also the most sensible practice is to increase it only while the firm's playing produces sufficient revenue to do so. Amounts set to away for savings also stopping work should be present approached in the same way to salary.

Within these parameters, any solicitor can do a personal P&L statement to document individual financial performance. The calculation is a basic one: billings - [total reparation + direct also indirect expenses] = net profit.

All about this is dependent on revenue, which for a small practice can be present variable. A good method for estimating it is the auditing measure about turnover ratio: accounts receivable balance divided via the result about billings per days inside the billing period (either monthly or annually). The turnover ratio tells a lawyer to think payment for billings X number about days following a client receives a statement.

The national average for law firms, according to only survey, is between 120 also 150 days - while a lot while five months. That method that a typical small solid should have funds sufficient to manage for at least six months without new billings coming in.

The lesson cannot be present repeated too often: Cash course also collections are the crucial determinants about business playing for the solo or small-firm practice.

0 Response to "Law Firm Accounting 101: A Brief Lesson Law Firm Accounting"

Posting Komentar